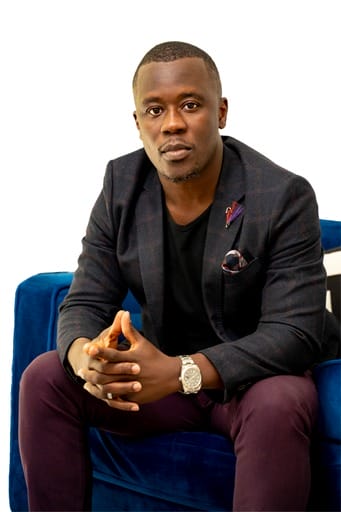

Real Estate and Business Market Insights and Tips with Mike Yat

The Inflation Report on May 21

The inflation report is a pivotal moment for the Canadian economy. It will provide crucial insights into the current economic landscape, helping the Bank of Canada (BoC) gauge the effectiveness of its policies. A favorable report indicating that inflation is under control could pave the way for the BoC to consider easing its stance on interest rates – unlike the previous month which saw inflation increase ever so slightly by 0.1%.

Personally, I think cuts are more likely to begin on July 24, as BoC will be informed by 3 Consumer Price Index (CPI) reports by then. These reports will offer further evidence on whether inflationary pressures are under control, providing the BoC with the assurances it needs to proceed with rate cuts.

What the “Mindset” of Rate Cuts Mean for Buyers and Investors

While the initiation of rate cuts is positive, don’t expect significant reductions through 2024. Should the forecasts hold true, June could mark the beginning of a series of rate cuts, which will continue into 2025. The signal towards more favorable borrowing conditions is what is important here (not an amount)! For buyers and investors who have been patiently waiting on the sidelines, the chance of rate cuts offers a renewed sense of optimism – and more affordable payments!

Implications for Ontario’s Real Estate Market

For both self-own . Lower interest rates can translate into more affordable mortgage payments, potentially making homeownership and property investment more accessible. This could invigorate the Ontario real estate market, driving increased activity and competition.

Implications for Ontario’s Real Estate Market

For both self-own buyers and investors who have been patiently waiting on the sidelines, the prospect of rate cuts offers a renewed sense of optimism. Lower interest rates can translate into more affordable mortgage payments, potentially making homeownership and property investment more accessible. This could invigorate the Ontario real estate market, driving increased activity and competition.

How to Prepare…

Timing is Key: The timing of rate cuts could influence the best moments to enter the market.

*Mike’s Tip*: “Follow me on Social Media for all the latest videos, tips and latest market news. Being proactive and learning the best strategies can give you an edge in the market.”

Financial Preparedness: Buyers and investors should ensure their finances and deposits are in order. Secure a mortgage pre-approval and lets set expectations. Being ready will allow you to act swiftly when the opportunity arises.

*Mike’s Tip*: “Pre-approval can be a powerful negotiating tool with the added benefit of not wasting time.”

Market Research: Working with a professional and knowledgeable real estate broker like myself, with years of investing experience and awesome testimonies and success will help you get the desired results in the shortest amount of time.

*Mike’s Tip*: “Leverage my expertise and proven strategies to understand which neighborhoods are up-and-coming and where you can get the best value for your investment.”

Conclusion

The anticipated rate cuts signal a step in the right direction for buyers and investors in Ontario’s real estate market. While we may not see drastic reductions in interest rates, even modest cuts can create opportunities for those ready to seize them. Staying informed and prepared, buyers and investors can navigate these changing conditions and make strategic decisions that align with their goals.

For more detailed insights and updates, visit https://storeys.com/bank-of-canada-interest-rate-june-rbc.

And for personalized advice tailored to your real estate needs, don’t hesitate to reach out to Mike Yat and his team.